Focus Growth

Highest ranked CASH COWS by the investment committee based on valuation upside

Inception

12/31/2006

Date as of

12/31/2023

Lead Portfolio Managers

Tim Call, CFA

(17-year tenure)

Lead Portfolio Managers

Mark Livesay, CFA

(15-year tenure)

Focus Growth

CASH COW Strategy

Highly concentrated portfolio of CASH COW companies (approx. 20-35) of all sizes with strong operating and free cash flow. Holdings include companies with solid long- term growth records and attractive future growth potential. Attractive entry valuations determined by CMC’s intrinsic value estimates allow for margin of safety and price returns that could exceed compounded earnings growth.

Focus Objective

- Long-term Capital Appreciation

- High-Growth Potential

- Capital Preservation

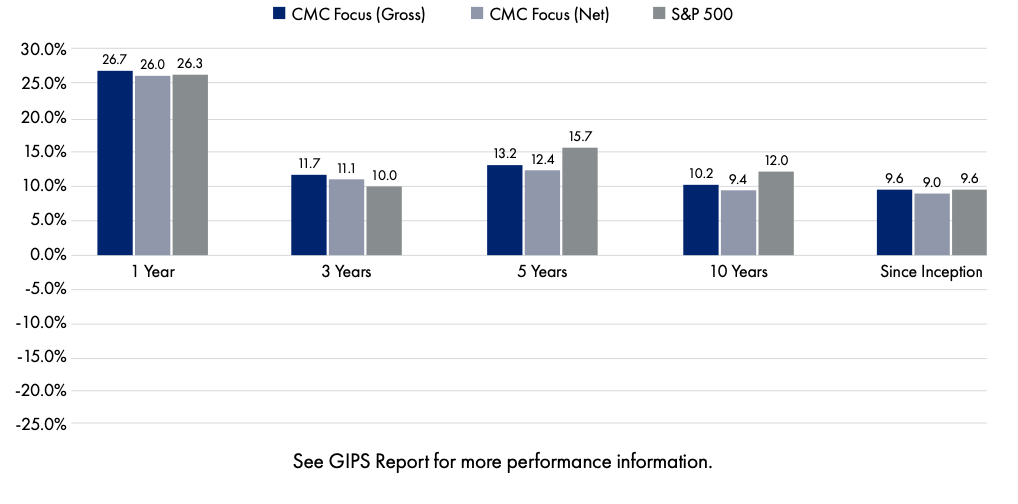

Focus Growth Annualized Performance Summary (Inception 12/31/2006)

As of 12/31/2023

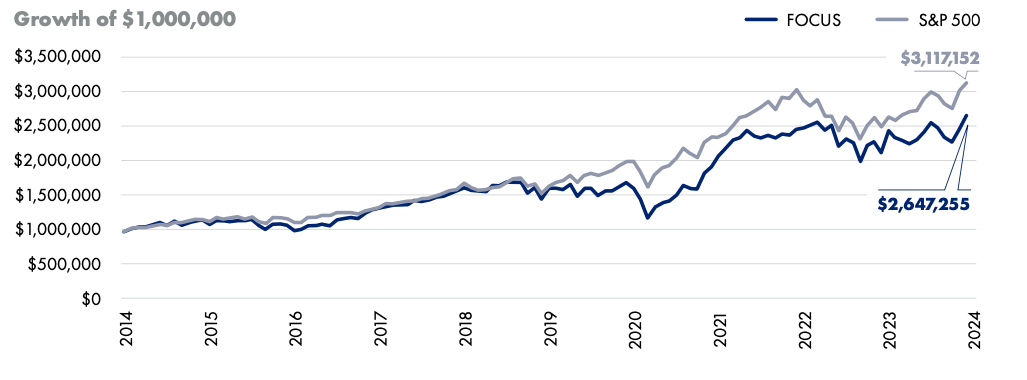

Focus Growth Composite Gross Returns

(12/31/2013-12/31/2023)

Disclaimers

The Capital Management Corporation claims compliance with the Global Investment Performance Standards (GIPS®) and has prepared and presented this report in compliance with the GIPS standards. The Capital Management Corporation has been independently verified for the periods 1 January 1997 through 31 December 2022. The verification report is available upon request. A firm that claims compliance with the GIPS standards must establish policies and procedures for complying with all the applicable requirements of the GIPS standards. Verification provides assurance on whether the firm’s policies and procedures related to composite and pooled fund maintenance, as well as the calculation, presentation, and distribution of performance, have been designed in compliance with the GIPS standards and have been implemented on a firmwide basis. Verification does not provide assurance on the accuracy of any specific performance report. GIPS is a registered trademark of CFA Institute. CFA Institute does not endorse or promote this organization, nor does it warrant the accuracy or quality of the content contained herein.

Notes:

1. The Capital Management Corporation is an independent investment management SEC registered firm and is not affiliated with any other entity. Policies for valuing portfolios, calculating performance, and preparing GIPS reports are available upon request.

2. The Focus Composite includes fully discretionary equity accounts which generally invest in U.S. domestic companies with a long-term growth bias. Investments include small, mid and large capitalization stocks. Stocks are evaluated using internal fundamental evaluation rankings. The portfolio is generally concentrated between 20-30 holdings. Prior to January 2020, the composite minimum was $100,000.

3. The benchmark is the S & P 500 Index.

4. Valuations are computed and performance is reported in US Dollars.

5. Total gross-of-fee returns are presented before management fees but after all trading expenses. Total net of fee returns are calculated using actual fees and/or model fees, where appropriate. The Capital Management Corporation’s current fee schedule is 1.00% on the first million in assets, 0.70% on the next four million, and 0.50% on the excess over five million.

6. The composite was created on January 1, 2007, the composite’s inception date is January 1, 2007. A complete list of composite descriptions is available upon request.

7. Composite dispersion is measured by the asset-weighted standard deviation of annual gross returns of those portfolios that were in the composite for the full calendar year. Where such portfolios number five or fewer, the standard deviation calculation would not be meaningful and that is indicated (n/m). Three- year standard deviation for both the composite (calculated using gross performance) and the benchmark index are shown beginning in 2011 in compliance with GIPS standards.

8. Past performance is not to be construed as a guarantee of future performance.